Hybrid sales models – why purely offline sales are obsolete

A survey of German insurance customers (McKinsey, 2020) has shown that 84 per cent use digital options in the customer journey, such as to research insurance policies. At the same time, however, more than half of those surveyed would not take out their insurance policy online.

A survey carried out by msg in cooperation with Versicherungsforen Leipzig offers similar conclusions: the majority of surveyed end customers still prefer to take out their policy through a broker. The results vary depending on the type of product: whereas relatively simple products are taken out independently online more frequently, customers seek personal advice on more complex products. Hybrid customers value the convenience and speed of digital services, but also the human factor of a trustworthy broker who is on hand to answer any questions they might have.

Digital is the new normal

For a long time, direct sales and sales through brokers were separate, which not infrequently caused confusion among customers. The customers were not aware that they are not entitled to utilise the services of an agency when they take out a policy directly.

Hybrid sales require customers to be able to switch channels at any point – and with no loss of information. If, for instance, customers have already calculated a tariff online and input the data, and now want a personal consultation because they have questions to ask, all the information provided so far has to be available to the brokers. In turn, it should be possible to view a broker’s offer online, check it and make changes independently if necessary.

Aside from interlinked sales channels, hybrid sales primarily means offering more digital options throughout the sales journey, from the option of booking a consultation online to a preliminary or follow-up discussion in the form of an online meeting, to the option of taking out a policy online. As such, hybrid sales touch on a broker’s entire value chain, from lead generation to consultation, conclusion and support, to the administration of insurance contracts.

The Covid-19 pandemic was the catalyst

The Covid-19 pandemic helped drive the growing acceptance of digital services in the sales process by both customers and brokers. Video consultations played a minor role before the outbreak of the pandemic, until social distancing rules turned them into the only way to communicate with customers face to face. It became clear in impressive fashion who was already equipped to offer their customers these communication channels and respond quickly to changing general conditions. According to the Digitization Study 2020 by Ernst & Young (formerly EY innovalue), the rate of use of self-services in 2020 was 62 per cent, placing it five percentage points higher than the previous year. Moreover, around half of those surveyed said they had communicated with their insurer by chat or video conference for the first time due to Covid-19.

Of the 3,000 end customers surveyed, 70 per cent thought online consulting channels were at least as good as traditional channels. 40 per cent of younger customers aged between 18 and 39 agreed that they had a more positive opinion of online consultations than before the pandemic. Experience has certainly led to more acceptance here: more than half of those surveyed used a video consultation for the first time during the pandemic. Customers continue to expect online appointments to be available and such services should be retained. It also makes sense for brokers to hybridise their sales from a business standpoint: the decrease in travel saves them time and money, which they are then able to invest in more in-depth support. That is not to say that personal appointments should no longer exist, although online meetings do make it possible to prepare for and follow up on them efficiently.

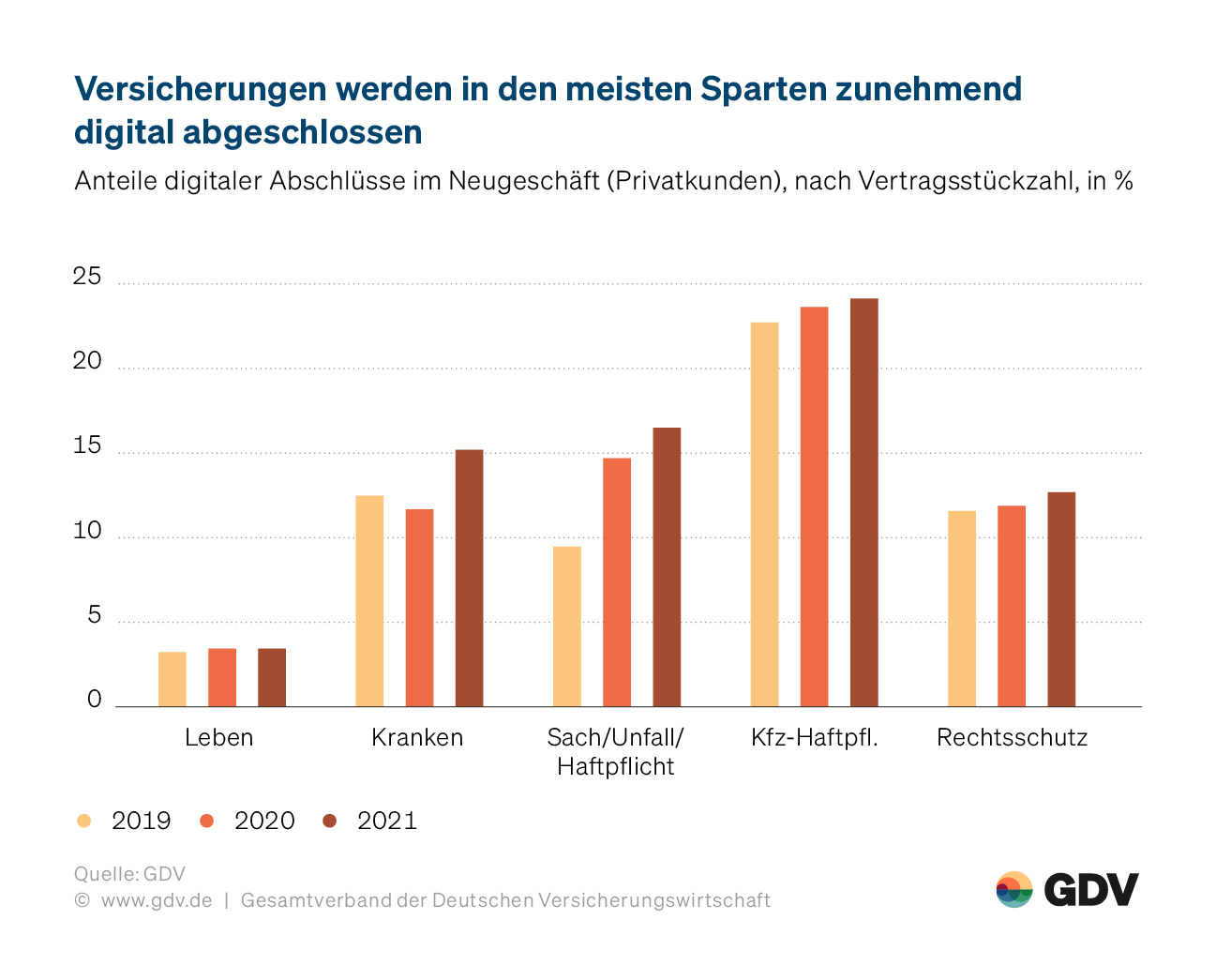

Statistics published by the German Insurance Association (GDV) show differences between insurance segments in terms of new digital business with private customers. On the one hand, this suggests that advice-intensive products are taken out online less frequently, which appears to explain the low proportion in the life segment and the high proportion in the vehicle liability segment. However, things are not quite so simple – products such as old-age pensions and life insurance, for example, require proof of identity to be provided, which throws up extra legal barriers to a purely online policy acquisition process and poses new challenges for insurers, brokers and customers. Lawmakers too should create other options here and insurers should examine whether digital ID cards, for instance, might be a new option in future. However, this would require greater acceptance of the digital ID cards among customers.

Headline: Insurance policies are increasingly being taken out digitally in most segments. Proportions of new policies taken out digitally (private customers), by number of contracts, in %

Life

Health

Non-life/accident/liability

Motor liability

Legal expenses

The new role of the broker

Brokers have three options at present: they can consult entirely offline or entirely online. Alternatively, they can benefit from the best of both worlds. Hybrid brokers do not compete with online sales, but rather occupy a growing niche in the market. The regular structural analysis conducted by the German Federal Association of Insurance Salespersons (BVK) underlines how far this approach has come in practice. For example, the study examines how many insurance brokers are already giving their customers the option of taking out a policy online, and how much of the total commission is attributable to online business. The results offer key insights into the hybridisation of sales.

Even the study carried out back in 2019 showed that the percentage of brokers offering online policies had increased, and was sitting at 65 per cent. However, 16 per cent indicated that they were not generating any revenue online at the time. For another 47 per cent, the share of insurance policies taken out online accounted for no more than 5 per cent of their total revenue. The recent study carried out in August 2023 is essentially consistent with these results, with the proportion of ways to take out a policy online offered by exclusive brokers having risen to 81 per cent, yet no other sales channels having experienced any major changes. It is interesting that brokers and multi-tied agents are less ‘online’ – perhaps they select their own sales tools and decide for themselves whether the infrastructure is worth the cost. In contrast, exclusive brokers’ general conditions are set out for them by the companies, such as whether online sales are to be rolled out across the board.

Insurers must pave the way for hybrid sales models

Hybrid sales only work as well as insurers are able to support the model with strategies, technology and processes. Not all companies involve their brokers in their online strategies – these sales channels continue to be dealt with separately. However, the BVK’s structural analysis does highlight some insurers who integrate their brokers with great success.

The stronger integration of sales and service is of equal importance to successful hybrid sales models. These too should undergo hybridisation: service staff utilise their contact with customers to practise cross-selling and up-selling, whereas sales staff perform the role of brokers of additional services. All too often, this necessary process of amalgamation is obstructed by a departmental way of thinking with rigid responsibilities, processes and data protection issues – who is allowed to use what information, and when.

Strategy and processes notwithstanding, the technical aspect is of key importance. Brokers must be able to make it possible to process an application directly online through appropriate interfaces. Moreover, insurers can and should equip their sales partners with the necessary technical tools (such as homepages, tools for booking appointments, online meetings and online signatures) and enable them to utilise these effectively. To name one example, Ergo launched a range of ‘Hybrid broker’ workshops back in 2020, as Dr Gerald Gast, a former member of the Management Board of Ergo Beratung und Vertrieb AG, explains in an interview with cash-online. These workshops were centred on digital services and solutions that Ergo had lined up for sales partners as part of its strategic realignment. These included individual websites and digital tools for customer communication such as WhatsApp, social media tool kits and a user-friendly online appointment booking process. They were supported by digital application processes, innovative apps and QR code signatures for contractual documents.

Hybrid sales – digital and personal

Hybrid sales models see digital products and services and personal contact not as mutually exclusive, but rather as allies. The best way to use modern technology is to help brokers offer the best service possible and offer customers personalised advice to suit their needs based on extensive knowledge. Insurance will remain a ‘human’ business, with technology providing brokers with increasingly effective tools. The course for the future is set towards hybrid insurance sales, which make it possible to support a changing society faster, remotely and more cost-effectively, and anyone who misses the boat will tend to lose their market share.