The future of insurance sales

‘Hallo, Herr Kaiser’ – do you remember the famous German slogan? For more than four decades (1972–2009) the advertising figure of Hamburg-Mannheimer (now Ergo) characterised the stereotypical image of the charming insurance agent by regularly appearing on the television sets of German households.

Herr Kaiser embodied the classic agent who advises his customers on insurance matters in person and is even recognised by children on the street. He therefore symbolises proximity, long-standing customer relationships and personal customer contact.

Today, Herr Kaiser would encounter completely new challenges, as the world of insurance sales has changed dramatically since then – and will continue to do so. But how exactly will his role change? How will new technologies and digital solutions support him – or will they even replace him? In this article, we take a look at the exciting future of insurance sales.

Customers want flexibility – insurance sales are becoming hybrid

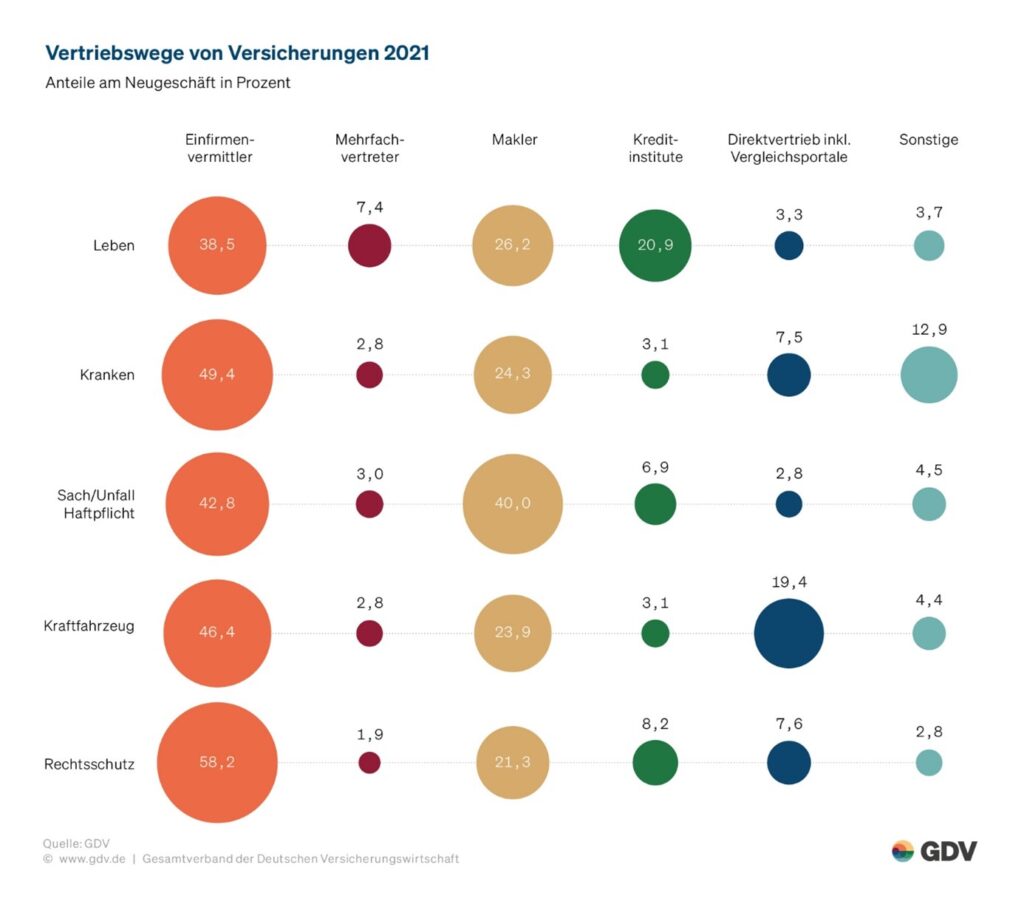

The assumption that sales through a broker would ‘die out’ has long been conjured up, but has not yet occurred. A look at the current sales channel statistics from the German Insurance Association (GDV) shows that sales through brokers remain the dominant sales channel across all segments. However, this should not obscure the fact that the weightings are shifting and elements of direct or online sales are gradually finding their way into traditional sales channels. The boundaries are becoming blurred and are ideally not visible or perceptible to the customer. After all, the customer journey of today’s customers is hybrid, which means that customers change channels depending on their concerns – or at least want to do so. In practice, however, things are often very different, with cumbersome processes and unwanted media breaks often more the rule than the exception. What remains are dissatisfied customers who feel that their needs have not been met well enough or even at all.

Current sales channel statistics from the German Insurance Association (GDV) / Share of new business in per cent Top row: Einfirmenvermittler (Exclusive agents), Mehrfachvertreter (Independent agents), Makler (Brokers), Kreditinstitute (Credit institutions) Direktvertrieb inkl. Vergleichsportale (Direct sales incl. comparison sites), Sonstige (Other) Left-hand row: Leben (Life), Kranken (Health), Sach/Unfallhaftpflicht (Property/accident liability), Kraftfahrzeug (Motor vehicle), Rechtsschutz (Legal expenses). Source: GDV

The risk of migration is still manageable, as potential policyholders still face such customer experiences with most traditional insurers. Insurers continue to rely heavily on traditional, stationary sales channels and strictly separate online sales from the other sales channels. Today, customers have to choose between having a personal point of contact or self-service processing via digital offerings such as customer portals. However, insurers will not be able to maintain this strategy for much longer. Other industries have been demonstrating for years how a hybrid, well-integrated customer journey can work and are also setting standards for the insurance industry. The new digital insurers on the market have recognised this gap and are pioneers in customer-oriented sales beyond the analogue world with simple digital, but nevertheless personal, processes.

Herr Kaiser as a bot? Experiments with AI: ChatGPT

The digital insurer Lemonade, for example, has made it its mission to make taking out insurance as easy as possible. And that goes down very well with customers: ‘@Lemonade_Inc was the easiest insurance policy I’ve ever taken out. “Traditional” insurance companies need to take a step into the current century!!!’, reads a customer quote on the website. An important role in this process is played by Maya, a Lemonade chatbot, who guides potential customers through the process of taking out a policy with a few simple questions. However, chat or voice bots are also increasingly finding their way into the digital customer journey at established insurers and offer customers the opportunity to receive quick answers to their questions about insurance products.

According to a press release dated 30 March 2023, Helvetia Switzerland even has a chatbot that uses the generative AI ChatGPT to answer questions. The service is still experimental in nature, but in the long term it is intended to simplify access to insurance and pension products. In order to use AI-based chat or voice bots not only to answer customer enquiries, but also to provide actual advice on an insurance product, questions still need to be answered regarding the legality of what an AI says. There will be more exciting use cases for the use of generative AI in the near future. It will not replace the broker, but it will be able to provide substantial support in the consulting process.

Today, customer proximity means being there where the customer interacts

Alongside customers becoming more hybrid, another trend can be observed that will change sales in the future. Regionality, the previous USP of traditional sales channels, is becoming less important. In the future, proximity to customers will also mean being available and, above all, present on their devices. When customers no longer visit an agency and brokers no longer come to their homes, other ways of recognising changing needs and life situations are needed.

In the future, support will mean more than ever knowing customers, identifying opportunities for contact and thus uncovering new needs.

Know your customer – a 360-degree view of the customer

This information about customers is indispensable here. In a study conducted by PwC and Versicherungsforen Leipzig, 47 per cent of the insurance experts surveyed stated that they did not have enough data to create individual customer experiences (source: PwC/Versicherungsforen Leipzig, study ‘Die Zukunft des Kundenmanagements’ [‘The Future of Customer Management’], 2020). However, a look at the real world shows that insurers already have a great deal of data, but it is not being consolidated and used appropriately. A 360-degree view of customers makes it necessary to interlink data and systems. A central customer database in which all customer information is stored and which can be viewed by all employees is the be-all and end-all for the sales of tomorrow. At present, this view is largely non-existent in the insurance companies. Heterogeneous system landscapes are often cited as a relevant challenge here.

Next-best-action concept

Intelligent consulting and sales-supporting solutions that follow the next-best-action concept are getting better and better with the knowledge of their own customers, and offer both sales partners and sales-supporting units real support in the advisory process. This is a communication approach in which, based on the analysis of historical customer data using AI, the ‘next best action’ is determined and proposed for the respective players. Technical support will play an important role in sales. Synchronised information about customers allows for a much more personal approach and interaction – both through self-service solutions and through personal points of contact. This allows the latter to focus more on providing individual customer support and work more efficiently. Against the backdrop of growing problems with junior broker staff, this is an important response to the current shortage of specialists in sales.

However, digital transformation alone is not enough to meet the challenges of the future. In addition, insurers have to work on the organisation and break down existing silos. They need structures where people from different value-creating areas – such as marketing, sales, customer service and IT – work closely together and share information to ensure a consistent focus on the customer experience. All activities should therefore contribute to the customer journey and customer satisfaction in the future, and not just optimise the processes of individual departments. It is a brave new world for Herr Kaiser, one in which he will quickly find his feet with the support of skilled IT partners with integrated solutions.