Sustainable pensions under changing conditions

While life insurers and other providers of private and company pensions have been struggling with low interest rates for years, the situation changed suddenly in 2022. Interest rates have skyrocketed in the last months and are expected to rise further.

A changed interest rate situation

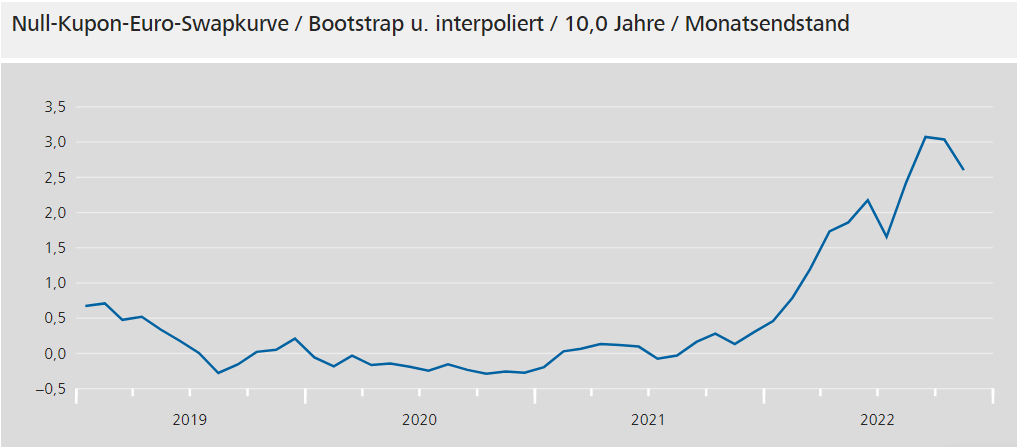

Consider, for example, the zero coupon euro swap curve for ten-year investments. The figures, which have been within a narrow range of 0 per cent since 2019, have risen to over 3 per cent in the course of 2022.

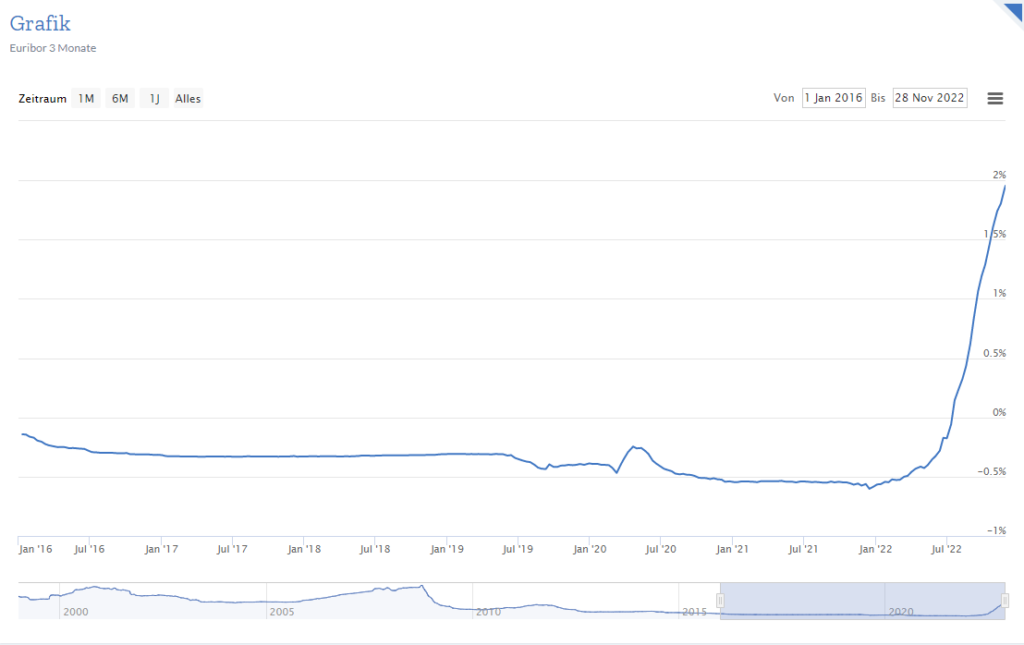

The development of Euribor interest rates, such as the 3-month Euribor, is a good indicator of shorter investment periods. It has been consistently negative since 2016, reaching around -0.5 per cent last year. The three-month Euribor has been increasing since 2022, moderately at first and then accelerating. It crossed the zero line in July 2022 and reached 2 per cent in December 2022.

(Source: https://www.euribor-rates.eu/en/current-euribor-rates/2/euribor-rate-3-months/ (30 November 2022))

Rising inflation

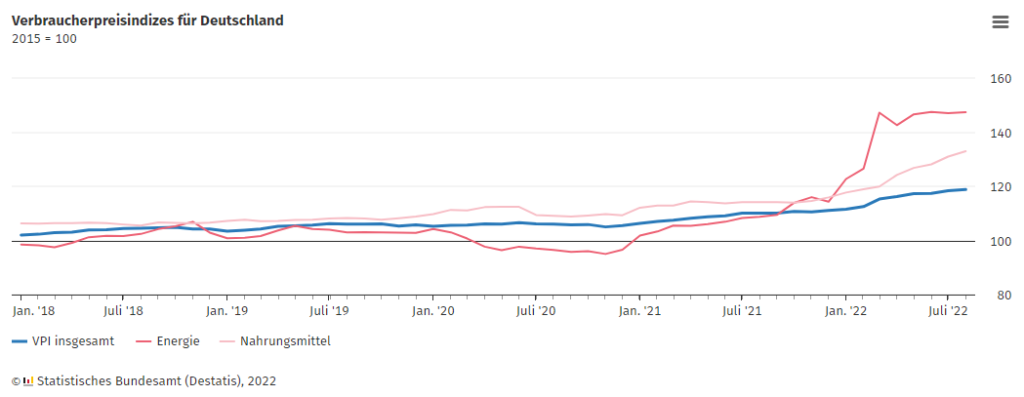

The changed interest rate situation is due to changed macroeconomic conditions, which are reflected in particular in a sharp rise in inflation. The first signs of this came in 2021, the second year of the Covid-19 pandemic. As a result of the Russian war of aggression in Ukraine and the sanctions, energy and food prices have risen massively in some cases, as reflected by the consumer price trends.

Increased inflation has been noticeably above the ECB’s inflation target of 2 per cent annual inflation for some time now. In response, the ECB raised the main refinancing rate (ECB base rate), which has been 0.0 per cent since 10 March 2016, in several stages – from 0 to 0.5 per cent on 21 July 2022, to 1.25 per cent on 8 September 2022 and to 2 per cent on 27 October 2022. Further interest rate hikes are expected.

The challenges of volatile interest rates

How will the sudden change in interest rates affect life insurers and providers of company pension schemes? In doing so, we want to distinguish between new business and effects on the portfolio. New business is being dampened by a gloomy economic outlook because long-term pension provision is often not a top priority when the outlook is uncertain. On the contrary, there are also large savings balances for which high-yield, secure investments are sought in the event of high inflation.

The effects on companies’ contract portfolios may vary. Companies with large portfolios of long-term guarantees for traditional pension products are affected to a different extent than companies whose portfolios consist mainly of risk products and unit-linked savings products.

For portfolios with long-term guarantees, the increase in interest rates affects both the supplementary interest provision and the valuation of investments in fixed-interest securities. While the supplementary interest provision now allows withdrawals instead of the previously required additions, there are now increasingly hidden liabilities in the case of fixed-interest securities rather than the usual hidden reserves. Even if the hidden charges are often not realised because the securities are held to maturity.

In the area of product development, there are isolated voices calling for a return to the ‘good old days’ in view of rising interest rates and for a renewed focus on traditional insurance products. However, as volatility in the capital markets is likely to continue, we expect product development trends towards reduced guarantee commitments and increased participation in capital market earnings opportunities to continue. Find out more in our next blog post.